53+ how much of your mortgage interest is tax deductible

Web For example if you rent out the property for a total of two months in the year you can deduct 212 167 of your mortgage interest. However higher limitations 1 million 500000 if married.

Mortgage Tax Deduction Calculator Homesite Mortgage

The interest on an additional.

. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Also you can deduct the.

5 Steps to Successful Real Estate Accounting for Investing Newbies. Web These tax deductions can lower your tax liability. Web If your mortgage was in place on December 14 2017 you can deduct interest on a debt of up to 1 million 500000 each if youre married and file separate.

Did Your Know You Can File Taxes Online with HR Block. Web You may find the mortgage interest deduction to be your most valuable tax break as a homeowner but you need to get up to speed on the most recent rules. Did Your Know You Can File Taxes Online with HR Block.

Background New Limit Equity Debt Interest Interest Tracing Refinancing The. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Get Started On Your Return Today.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web For the 2019 tax year the mortgage interest deduction limit is 750000 which means homeowners can deduct the interest paid on up to 750000 in mortgage. Web If you took out your mortgage on or before Oct.

If your second property is considered a personal residence you can deduct mortgage interest in the same way. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Mortgage Interest DeductionPersonal Residence.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Homeowners who bought houses before.

Web Your total mortgage debt including home equity was 1 million or less or 500000 or less if you were married but filing separate returns for mortgages taken out. Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. Get Started On Your Return Today.

Web Basic income information including amounts of your income. Also if your mortgage balance is. 16 2017 then its tax-deductible on.

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Ad File Your Own Taxes with HR Block Online and Get Your Maximum Refund Guaranteed. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

That means that the mortgage interest you. Discover Helpful Information And Resources On Taxes From AARP. If you are single or married and.

Web Has Tax Reform Taken Away Your Home Mortgage Interest Deduction. What is the home mortgage. 13 1987 your mortgage interest is fully tax deductible without limits.

Ad File Your Own Taxes with HR Block Online and Get Your Maximum Refund Guaranteed. If you rent it out for a total of. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Walmart S Food Stamp Scam Explained In One Easy Chart Jobs With Justice

What Tax Breaks Do Homeowners Get In New York

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

.JPG)

Help To Buy Scheme Estate Agents Sandersons

Mortgage Interest Deduction How It Calculate Tax Savings

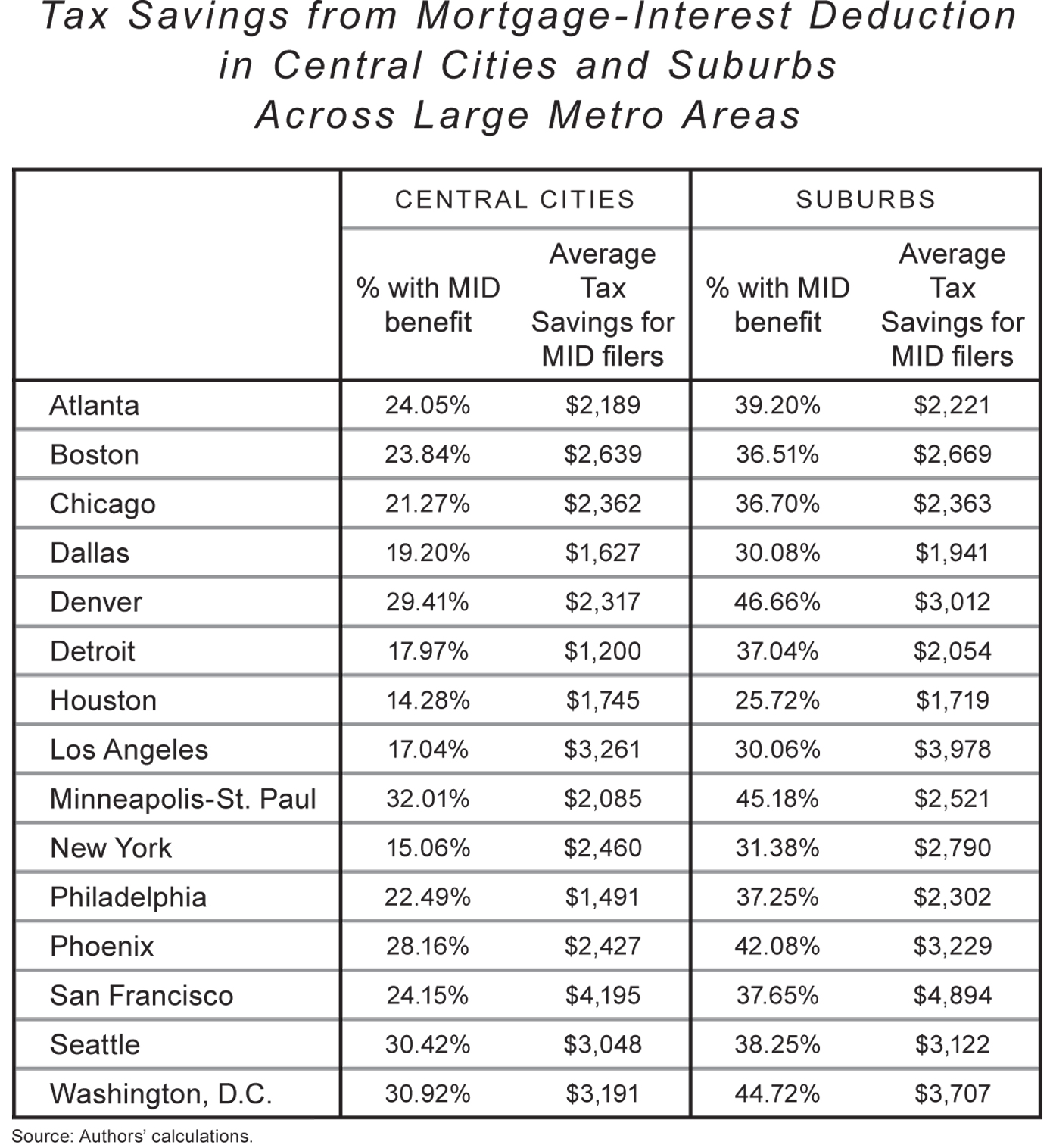

It S Time To Gut The Mortgage Interest Deduction

The Home Mortgage Interest Deduction Lendingtree

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Statement 10 Examples Format Pdf Examples

Rethinking Tax Benefits For Home Owners National Affairs

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep